by

User Not Found

| Jan 04, 2019

By Tim Thomas and Julie Parisio Roy

Concentrated equity positions are one of the best ways to quickly accumulate wealth, but they can also have significant downside risks. In this post, we will cover the basics of concentrated equity positions and some techniques we use when developing customized strategies to mitigate the risks associated with them.

What are concentrated equity positions and where do they come from?

A concentrated equity position occurs when a substantial portion of an individual’s assets are comprised of a single stock. These large positions can be generated by several methods as described below, and are common amongst founders of successful companies, employees in the technology and biotech industries, as well as long tenured members of publicly traded companies. Of course, they may also be acquired through an inheritance or being an early and long-term fan of a company that’s grown over many years.

Concentrated equity positions are often generated from employee benefit packages that include:

- Stock purchase plans

- Restricted stock units (RSUs)

- Non-qualified stock options (NQs)

- Incentive stock options (ISOs)

What risks are associated with concentrated equity positions?

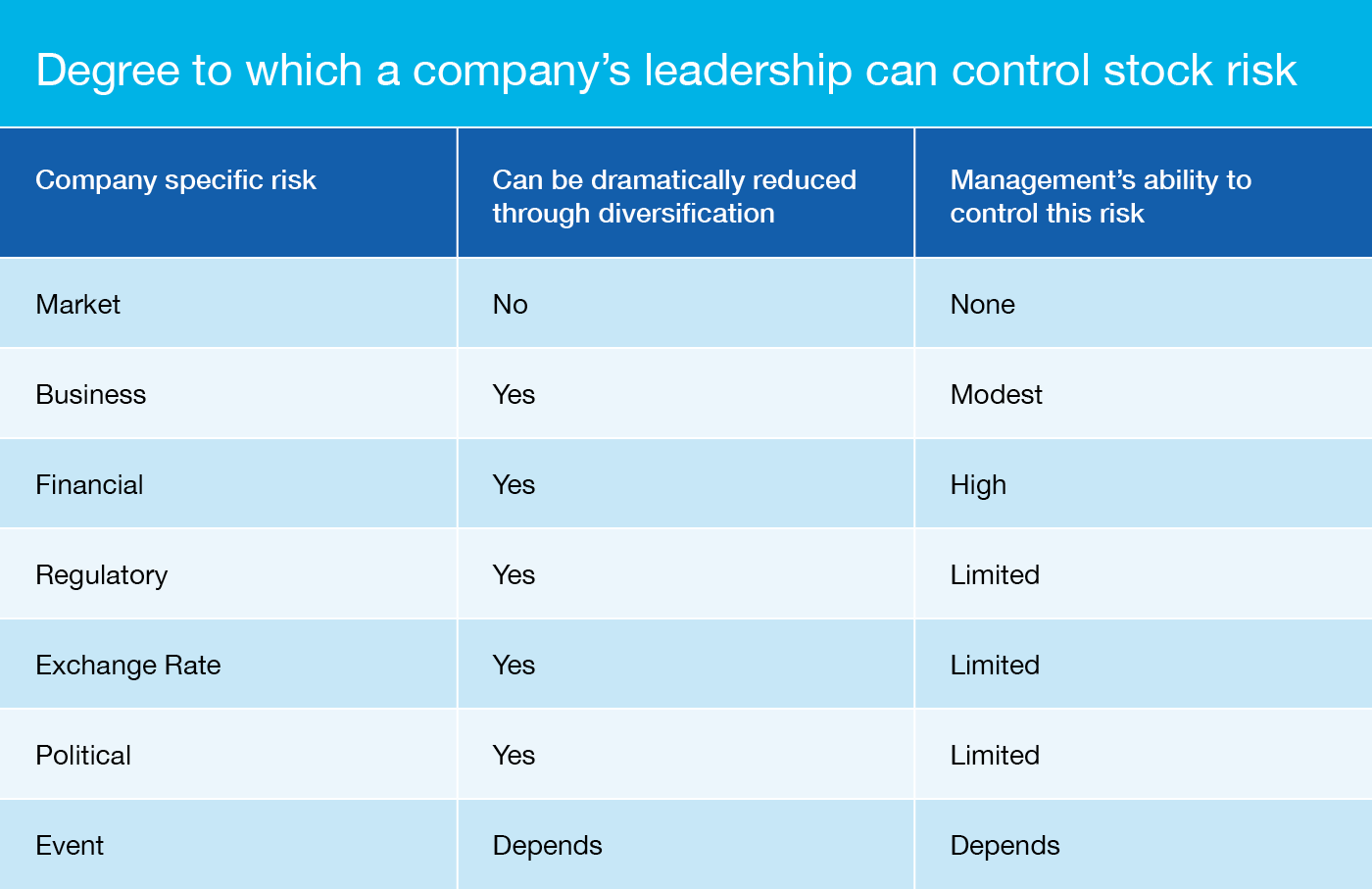

As with any stock position, there are risks inherent with equity ownership, but they are magnified by the size of the concentrated position. Notably, some of the risks can be managed by the leadership team at a company, but many of these risks are out of their control. That is perhaps one of the greatest uncertainties to reconcile when developing a strategy to manage concentrated wealth.

The risks can be categorized as follows:

1. Market, economic, exchange rate, regulatory or political risks

- These risks are mostly related to “exogenous” factors outside a business’ control, such as a market downturn, economic slowdown or change in political environment.

- These risks can be difficult to diversify away and management generally cannot control them.

2. Company-specific risks

- These risks result from business decisions, such as the failure of a new product line or an accounting scandal.

- These risks can usually be controlled by management and can be dramatically reduced by diversification.

3. Event-specific risks

- These are one-off situations such as a military attack or natural disaster that may result in a decline in the stock price.

- Management may or may not be able to control these risks, and diversification may or may not help reduce these risks—it all depends on the situation.

Are investors adequately rewarded for the risks associated with concentrated positions?

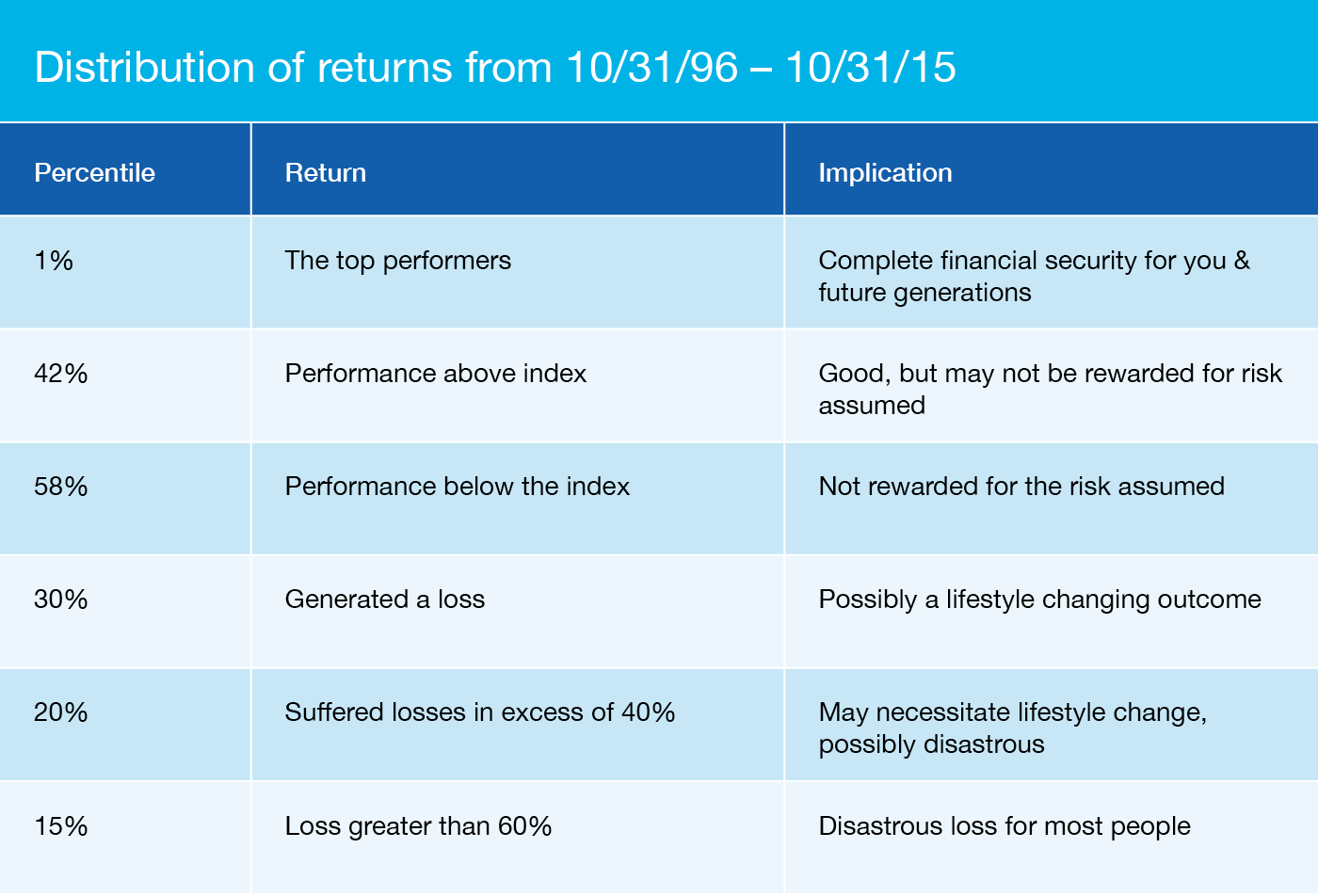

No. When you look outside the most recent bull market, there is a wide range of outcomes for performance of individual stocks. In some cases, concentrated positions can be a ticket to extreme wealth and multigenerational financial security. But more frequently, concentrated positions either underperform a market index or slightly outperform, but not by enough to compensate for the added volatility and risks. In a worst-case scenario, the position could go to zero, resulting in a disastrous loss and requiring a significant lifestyle change.

These findings were developed through a series of studies in which we analyzed the historical performance of the stocks in the Russell 3000 Index. These studies indicate that there is a wide range of outcomes. For example, stocks that performed in the top 1% provided a return that was at least seven times larger than those provided by the index. Unfortunately, this is a small club as the top 1 percent only includes 30 companies.

58 percent of the stocks generated returns below the index. In fact, the median performer generated a cumulative return that was 2,200 basis points, or 22 percent, less than the benchmark. Investors in this segment paid a significant price as they assumed far higher risk than the index for stocks that were also underperforming.

Clearly, the most problematic outcome is when the concentrated position generates a large loss. In our study, 20 percent of the stocks had losses of 43 percent or more. Even more alarming, 10 percent of the stocks lost nearly all their value.

Local case studies: Washington Mutual vs. Amazon

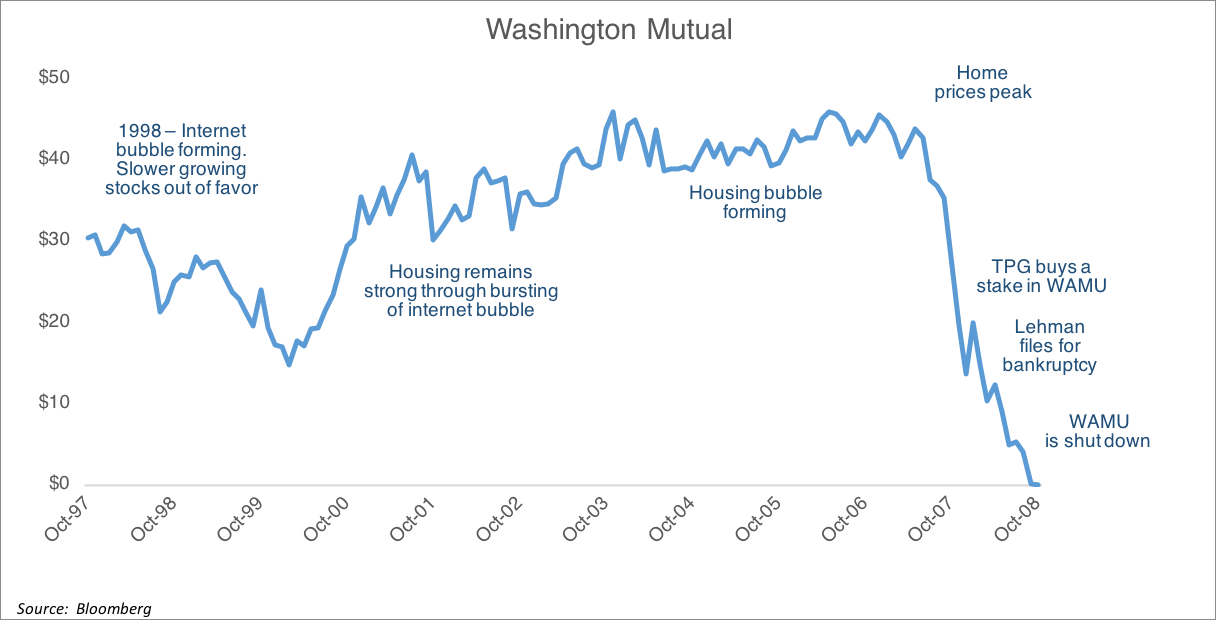

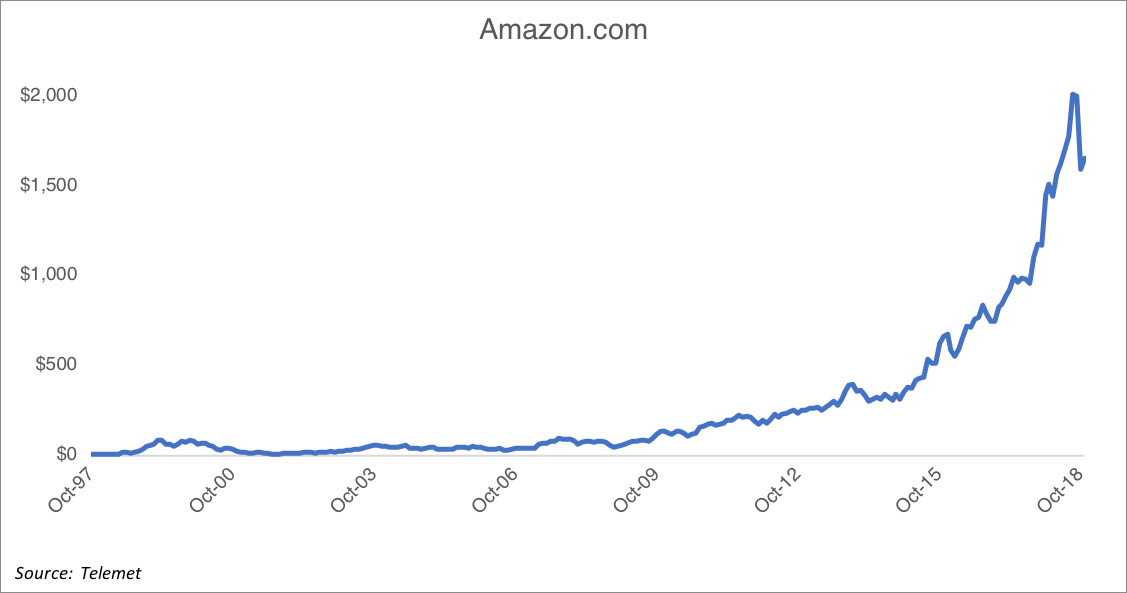

Consider two local companies, Washington Mutual and Amazon.

A concentrated equity position in Washington Mutual would have had a disastrous result, permanently impairing the value of an investor’s portfolio if they had not diversified prior the company’s demise.

Conversely, Amazon employees with restricted stock units that were granted years ago may now have significant wealth concentrated in the company stock. AMZN stock has returned approximately over 2,800 percent over the last decade.

The results of these two companies demonstrate the wide range of possible outcomes, which emphasizes the importance of diversification.

Why don’t people diversify their concentrated equity positions?

Several behavioral reasons people don’t diversify their concentrated positions include:

1. Overconfidence and familiarity biases

- People tend to be overly optimistic when assessing their own capabilities or the skills of others they know personally, such as company management.

2. Anchoring and recency biases

- People tend to use recent history to disproportionately anchor their beliefs about where a stock’s price will go. As a result, investors tend to hold stocks that have an embedded loss (“I can’t sell now that my stock is down 30 percent, I’ll hold until it gets back up to where I bought it.”). This is a particularly dangerous mindset for investors with concentrated positions because a downward spiral in the stock price can require a significant lifestyle change.

3. Status quo bias

- People are generally more comfortable sticking with their current situation versus making a change. This tendency is more pronounced when there’s a wide variety of alternatives from which to choose. In the case of a concentrated equity position, there are many ways to manage the position, which can make it more difficult to assess and act on diversifying the concentrated position.

4. Tax aversion

- Understandably, many investors are averse to paying taxes, which can be significant depending on the cost basis and size of the concentrated position. However, we encourage clients to focus on maximizing total net worth, which means that it is often prudent to sell some of the position and pay tax on the gains. In many cases, we can provide advice on strategies to reduce the tax burden.

Ways to reduce risks associated with concentrated equity positions

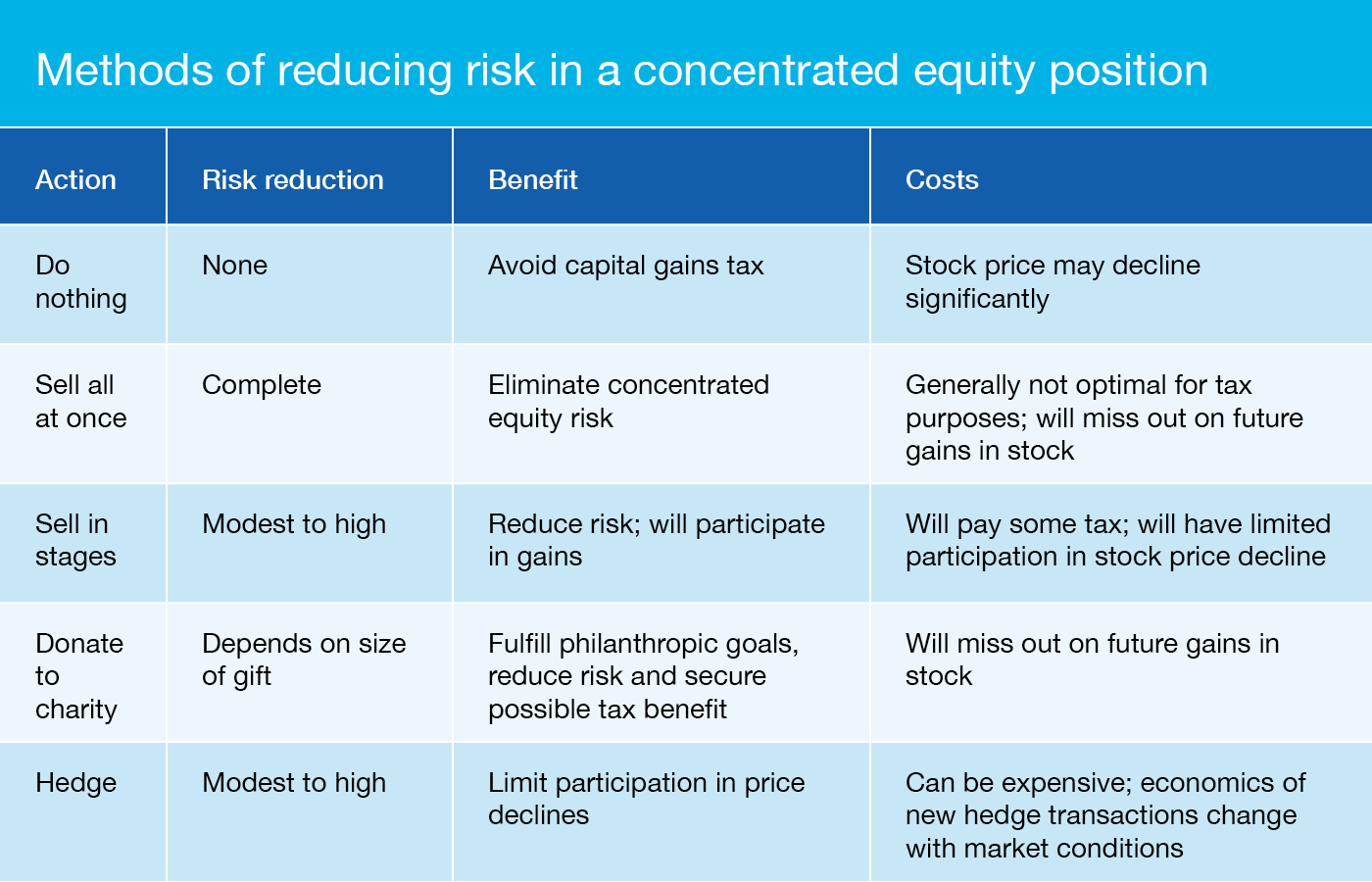

There are several ways an investor can reduce risks associated with their concentrated position as shown in the table below. The best course of action will depend on the outlook for the company, the investor’s specific financial position and planning objectives.

1. Sell all at once

- While this would eliminate the risk of the concentrated position, we generally do not advise this course of action since it can create excessive tax consequences and eliminate the opportunity to participate in future gains of the stock.

2. Sell in stages (time-driven or price-driven strategies)

- A common time-driven strategy is to sell at predetermined intervals, such as every quarter. For some executives, sales windows could be restricted by blackout periods or corporate events such as earnings reports. A preset diversification program (PDP) can help facilitate open market sales in these cases.

- Alternatively, investors can choose to adopt a price-driven strategy, whereby stock is automatically sold at predetermined prices. A common method used by company insiders to implement such a strategy is a 10b-5-1 plan. While these plans can at first feel restrictive, a carefully crafted plan will provide the investor with a straightforward sales plan.

- A combination approach includes a sales target for part or all of the concentrated position, while generating modest cash flow by writing covered calls. This strategy provides income upon the sale of the call option and effectively establishes an upside selling price for the stock.

3. Hedge the position

- Hedging can protect from a significant decline in the stock. There are many ways to achieve this downside protection, such as buying protective puts, collaring or customizing a hedge contract through an investment bank. However, all of these options carry costs, which can be a drag on overall portfolio performance.

4. Donate to charity: For the charitably inclined, donating a concentrated stock to charity can jumpstart philanthropic endeavors. There are several ways to approach this, and these two strategies are our current favorites:

- Charitable Remainder Trust (CRT): The trust can be funded with a large position of a single stock. The donor may receive a significant tax benefit and continue to collect income on a regular basis.

- Donor-Advised Fund (DAF): A DAF can provide tax advantages like a CRT, but there are several differences between the two strategies. Unlike CRTs, DAFs do not generate income for the donor. The advantage of donor-advised funds is that the receiving charities can be named at a date later than the contribution. In contrast, CRT rules require the charity to be named when funding the portfolio. For more information about DAFs, check out our blog post here.

A call to action

Concentrated stock positions can be a source of enormous personal wealth creation, but they carry significant risks. A custom monetization strategy can ensure financial security and maximize your charitable giving. Badgley Phelps’ long history of fundamental equity research, management of customized portfolios and commitment to comprehensive financial planning means you will have access to a unique team to create an optimal strategy for your financial life. If you have a concentrated equity position, the recent volatility in the market should demonstrate the need to develop a strategy to help manage the risks. Please let us know if we can help.