by

User Not Found

| Sep 09, 2020

September 9, 2020

Many people expect the stock market and the economy to move in tandem, but that’s not always the case. In recent months, the stock market has rebounded dramatically and set a record high. In contrast, the economy is recovering much more slowly.

Output remains well below its prior peak; the unemployment rate is high, and some businesses will never recover. Given the outbreak of COVID-19, the dichotomy between the stock market and the economy is puzzling to many people, but we have identified

three primary drivers of the recent rally in equity prices:

- Optimism surrounding both an eventual vaccine and new medical treatments that will pave the way for a return to more normal lifestyles and a growing economy

- Aggressive monetary policies employed by the Federal Reserve

- Trillions of dollars in aid from the U.S. government

A medical solution on the horizon

The mobilization of the medical community is a significant factor in the market’s recent optimism. Currently, a large percentage of the health care community is focused on developing vaccines, therapeutics and diagnostic equipment for COVID-19.

Given the magnitude of the effort, expectations are generally positive related to production of a successful vaccine with many estimates ranging from late fourth quarter of this year to early summer of 2021. This has helped to strengthen market sentiment

as many believe it is the only way to return to our lives as we knew them prior to the outbreak, at least in the near-term.

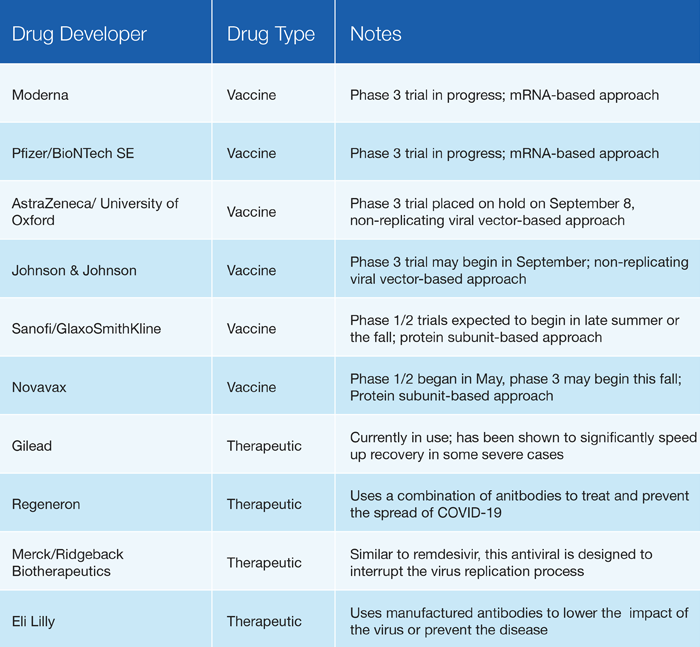

The World Health Organization reports that there are 34 candidate vaccines in the active clinical evaluation process and 142 candidates in the preclinical evaluation phase. The current leading candidates include vaccines that are being developed by Moderna and Pfizer/BioNTech SE. These and other developers are in late stage testing, which suggests that a vaccine is possible later this year. In the table below we have provided an overview of some of the drugs and vaccines

that are currently in development.

In order to provide some context for the status of these drugs, we have provided a summary of the three primary phases of clinical trials that must be successfully passed before a drug is approved for use in the U.S. The American Cancer Society’s description of each phase is provided below.

Phase One – Is the drug safe? The primary purpose of phase one studies is to determine the highest dose that can safely be given to a human.

Phase Two – Does the drug work? Once the drug has been determined to be safe, tests are conducted to determine if it works.

Phase Three – Is the drug better than other options available today? In phase three the drug is tested to determine if it is better than the current standard treatment.

When a drug passes all three phases of trials, an application can be submitted to the FDA for their review. If approved, the drug can be used and may even become the new standard of care.

Monetary stimulus and targeted aid programs

Aggressive action by the Federal Reserve has also been a significant factor in the market’s rebound. In March and April, the Federal Reserve took unprecedented steps to stabilize financial markets and normalize lending markets. They lowered the

target Federal Funds rate by 150 basis points to a range of 0.00 to 0.25 percent. They also announced a quantitative easing plan with no limit in its size and no stated end date.

The actions noted above are extreme, but the central bank took additional steps to ease financial conditions with the announcement of nine initiatives aimed at maintaining the flow of credit, facilitating properly functioning financial markets and stabilizing

economic conditions. These programs are notable as they go above and beyond traditional policy tools the Fed has used, such as maneuvering benchmark rates. Instead, these new programs are highly targeted and allow the Federal Reserve to provide support,

and in some cases serve as an active participant, in specific segments of the markets. Details on these programs are provided in the table below.

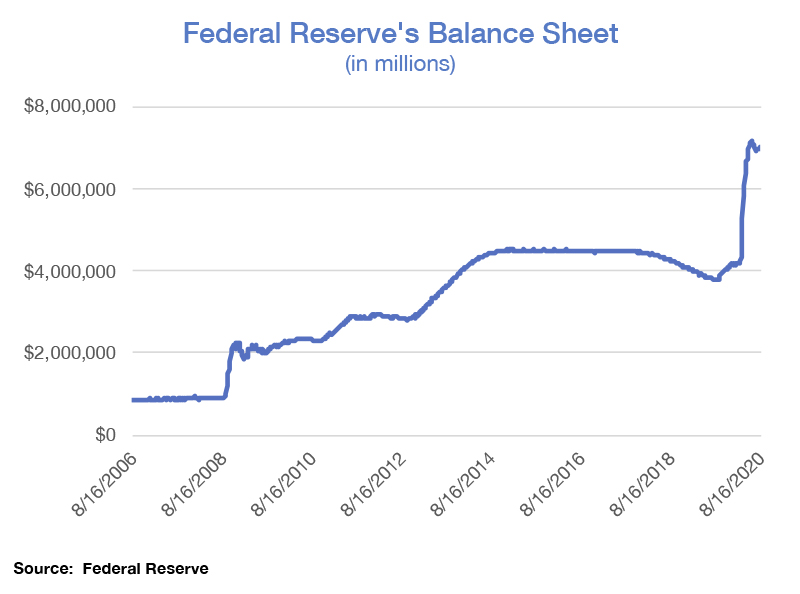

We analyzed the balance sheet of the Federal Reserve to quantify their rescue efforts and to compare the magnitude of their recent actions against those taken in other crises. Collectively, the quantitative easing and emergency rescue programs have increased

the size of the Federal Reserve’s balance sheet by more than $2.8 trillion in the five and a half months that span the beginning of March to mid-August (see chart below). That represents an unprecedented injection of capital and liquidity into our

financial system.

For the sake of comparison, it took almost six years for the Federal Reserve to increase their balance sheet by the same magnitude following the 2008 financial crisis. Notably, economic growth was unusually low during that time and the recovery

took many years. This time around our central bank is taking a more aggressive approach and their most recent economic forecast projects a strong rebound next year, with growth of 5 percent, followed by a 3.5 percent expansion in 2022.

Fiscal aid/stimulus programs

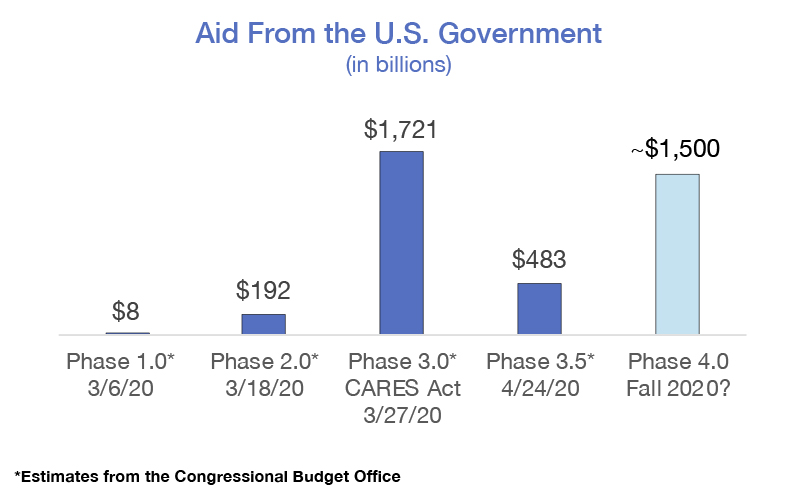

The U.S. government has also acted aggressively by providing an unprecedented level of aid. In a series of actions, the government enacted four programs that provided help to those in need (see chart below). At no time in history has the government

provided so much financial support. The Congressional Budget Office estimates that the CARES Act and the three other recently enacted programs cost more than $2.4 trillion, or more than 11 percent of last year’s GDP. Furthermore, Congress is

debating another round of aid that may be passed in the coming months. While the negotiations are ongoing, the package under consideration is expected to be in a range of $1 to $2 trillion and include enhanced unemployment benefits as well as checks to individuals in

need.

A bridge across the economic weakness

The outbreak of COVID-19 has engendered a health care crisis. Through the associated social distancing policies and stay-at-home orders, it also spawned a deep recession. However, it may also prove to be one of the shortest recessions on record as recent

data suggests the economy is growing once again. In short, the government aid and central bank programs are serving as a bridge to get us over the economic contraction until long-term health care solutions are developed. Since April, investors have

bought into this bridging concept and that has sparked a tremendous rally in stocks.

Ultimately this is a health care crisis and looking forward there will be an intense focus on the medical industry and their ability to develop

solutions. That will take time, but we have a vibrant biotech industry as well as some of the world’s best universities and research labs working to find answers. Accordingly, the market has taken an optimistic view of our ability to beat the virus

which implies an eventual return to more normal lives and a growing economy.