by

User Not Found

| May 24, 2023

Background

Historically, Congressional approval was required for every newly issued Treasury loan to fund spending. However, after that process became administratively burdensome, Congress gave the Treasury the authority to issue debt up to a certain dollar level; thus, the debt ceiling was created. Initially, the level was set at $11.5 billion in 1917. Since that time, the debt ceiling has been raised more than 100 times, most recently in December of 2021 to $31.4 trillion.

The present situation

Technically, the U.S. hit the debt ceiling in January, forcing the Treasury Department to start taking “extraordinary measures” to continue paying its obligations. Current obligations are being paid, but at a certain point funds will be nearly depleted. The timing of when those funds are fully spent is uncertain, but is currently projected to occur within the next several weeks. Secretary of the Treasury Janet Yellen recently estimated that the timing with which funds may be exhausted could be as early as June. The Congressional Budget Office (CBO), which produces independent analyses of the Congressional budget process, reached a similar conclusion.

We expect these estimates from the Treasury Secretary and CBO to be somewhat conservative, and the tone of the language used in the official statements from each party indicates a sense of urgency to encourage action. Ultimately, negotiating an increase in the debt ceiling is in the best interest of everyone. However, as is frequently the case in Washington D.C., politicians will likely use the issue as a potential source of leverage to achieve their desired outcomes.

Expectations for the future

We believe the most likely outcome is that negotiations will continue until the very last moment, with a high degree of media coverage. It is possible that the funds will be fully depleted without an agreement for a brief period of time, but ultimately we expect that a resolution will emerge. However, this recipe could lead to market volatility. For example, in 2011 the debt ceiling negotiations were contentious which resulted in challenges for the markets, impacting equities, credit spreads, mortgages, and currencies. While the stock market as measured by the S&P 500 Index fell about 18 percent during that period in 2011, it ended the year flat. Simply put, this “event risk” caused a significant, but temporary, market decline.

Long term consequences

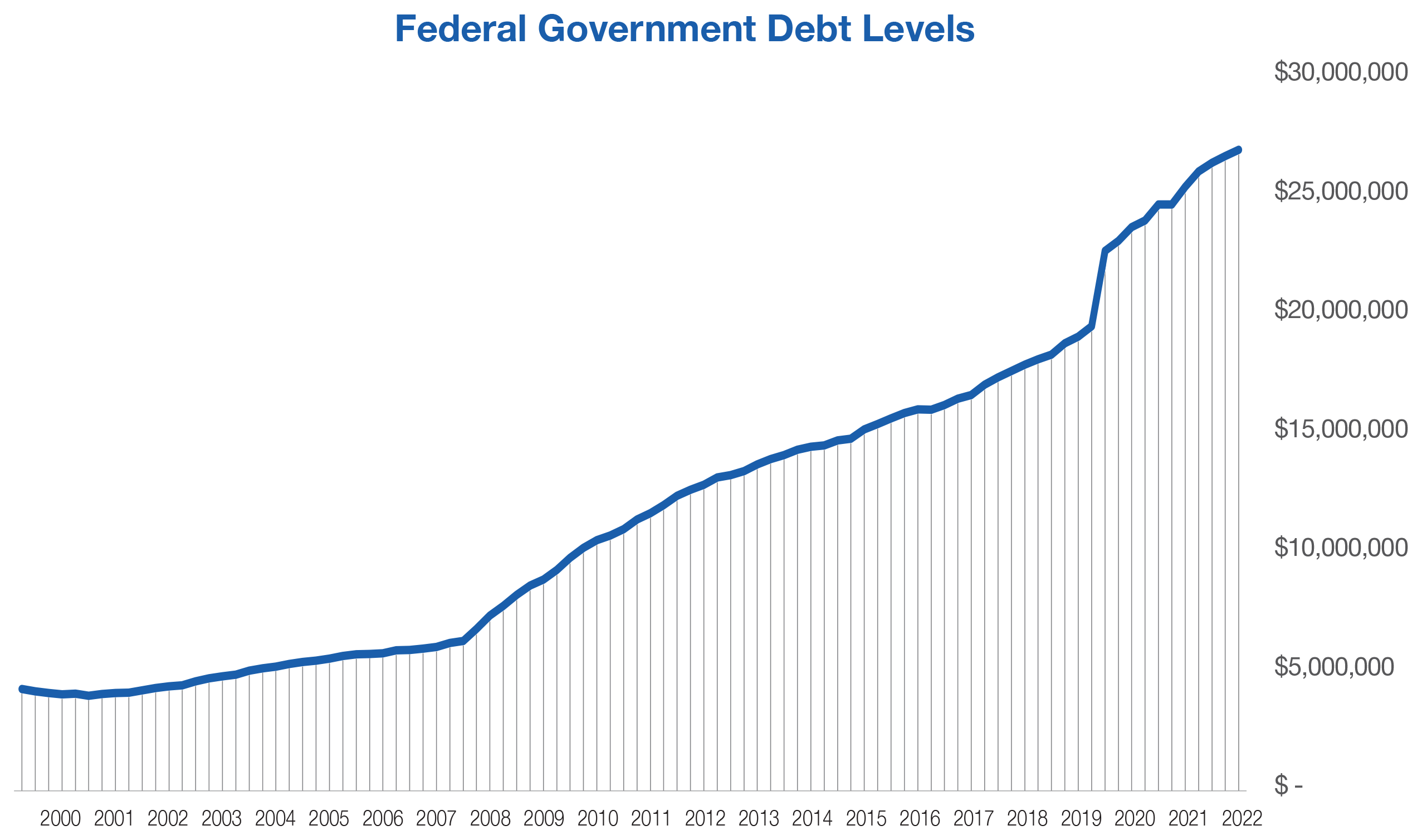

Ultimately, the critical question centers around how to balance government spending and revenues. In recent years, and more dramatically since the onset of the Covid-19 pandemic, government debt has ballooned (see chart).

The CBO estimates that the level of federal debt owned by the public will nearly double in the next 10 years, with the problem being exacerbated by higher interest rates. To move toward balance, spending may need to be reduced; however, this is a difficult goal to achieve given that roughly 65 percent of government spending is mandated by law. This mandated spending includes health care, retirement benefits, and income security. Defense is another significant expenditure, leaving little room to meaningfully cut spending levels and move toward a more evenly balanced budget.

A path forward

One path forward is through technological innovation and productivity gains. Given the significant scale and scope of the situation, market opportunities are becoming evident. Efficiency and productivity gains in areas including health care, defense, and industrial production are large addressable markets and we expect companies to play a significant role in serving these unmet needs. While there is no silver bullet, corporate America has economic incentives to work toward a resolution and this has historically been a source of value creation. Within the construct of our market-based economy, inefficiencies create opportunities for entrepreneurs and businesses that are nimble.

Consistent with our long-held investment philosophy, we seek to identify high-quality management teams as well as companies with significant competitive advantages, defensible business models and large and growing market shares. Over the long term we believe these types of characteristics lead to high returns on capital and consistent value creation. The problems of today are the opportunities of tomorrow, and we seek out these opportunities on behalf of our clients.

If you’re interested in discussing this topic, or how it may impact your own personal financial situation, please reach out to our team.

Originally published on May 24, 2023