by

User Not Found

| May 25, 2017

How to allocate your investments among different types of accounts to potentially increase your after-tax return

By Jeff Walters

The goal of every investment should be to maximize your return after all costs and taxes for a given level of risk. After all, the amount left after taxes and other fees is the money that you will be able to use to fund your financial goals. Here we will explore the concept of asset location as a way to mitigate the effect of taxes on your returns. Fees and other costs may also reduce your portfolio’s return and should be considered when making decisions regarding your investments and the types of accounts that hold them. However, fees and costs are beyond the scope of this analysis.

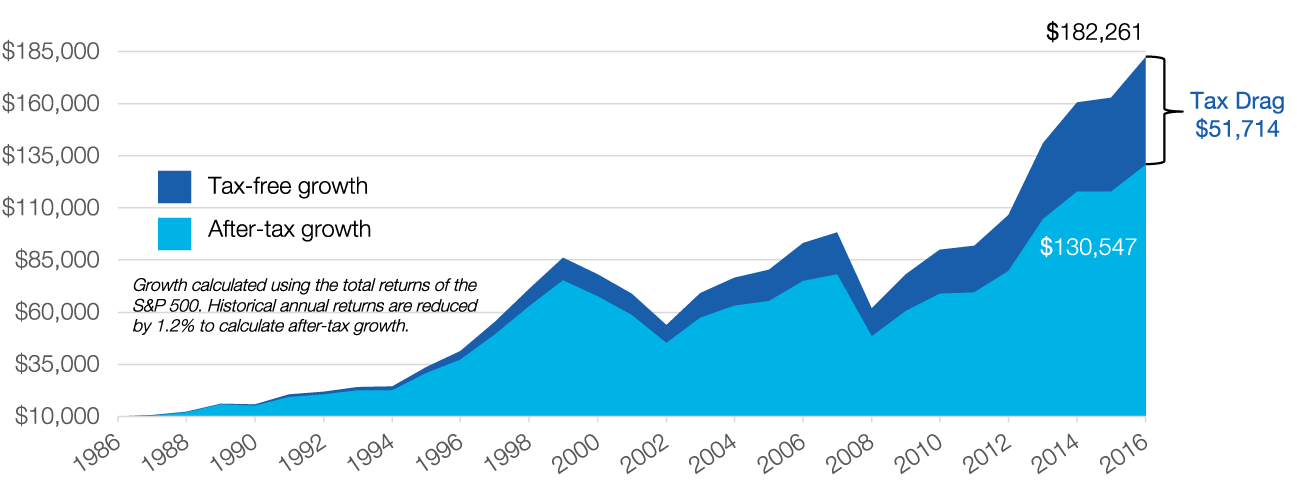

Many investors underestimate the impact of taxes on their portfolio’s performance. According to Morningstar, over time the average equity mutual fund return is reduced by 1 – 1.2% per year due to taxes (see the illustration below). By reducing this annual “tax drag” you can increase your after-tax rate of return over time.

Growth of $10,000 over 30 years

This doesn’t mean you should neglect the pre-tax return, or let the “tax tail” wag the “investment dog.” It’s most important to select appropriate investments that support your objectives and address your risk tolerance to begin with.

Let’s assume that you have worked with an adviser to determine your optimal asset allocation. With the asset allocation set to fund your financial goals, taxable investors should consider applying the concept of asset location as an extension of their asset allocation strategy to reduce the “tax drag” on their portfolios.

The concept of asset location is based upon the recognition that certain investment accounts (IRAs, Roth IRAs, regular taxable portfolios, etc.) will be more or less efficient for certain types of investments because of the taxability of the type of investment accounts along with the tax treatment of the investments held in those accounts. To apply an asset location strategy to your portfolio, you select which assets should be in your taxable accounts and which to place in your tax-advantaged accounts.

In general, you want to put tax-efficient investments into taxable accounts and tax-inefficient investments into tax-deferred or tax-free (Roth) accounts.

It is important to note that not all investors need to be concerned with asset location. If all of your investments may be held in tax-advantaged accounts, this strategy will not be necessary.

How are different types of investments taxed?

To evaluate the tax efficiency of your investments, it is essential to know that different types of investment income are treated differently by the IRS. In general, income from taxable bonds, CDs, savings accounts, REITs, private businesses, preferred stock, and limited partnerships are taxed at ordinary income tax rates. The top rate in 2017 is currently 39.6% for taxpayers filing jointly and earning more than $470,700. Conversely qualified dividends from most common stocks and gains from selling an investment you’ve owned over a year are taxed at a lower capital gains tax rate of 0 – 20% depending on your tax bracket.

2017 Federal Income Tax Brackets

Also, for investors earning over $250,000 and filing jointly there is an additional 3.8% tax on most investment income, which brings the top marginal rates to 43.4% and 23.8%, respectively. Finally, interest income from municipal bonds is generally tax-free.

Which investments are tax-efficient and which are not?

The income and growth from tax-efficient investments will usually qualify for a more favorable capital gains treatment or will not be taxed at all in the case of municipal bond interest. Municipal bonds, common stocks, most equity index funds and ETFs are examples of tax-efficient investments.

Examples of tax-inefficient investments include taxable bonds, high dividend yielding stocks, many partnerships or partnership-like investments (LPs, REITS, etc.), most actively managed mutual funds, and any strategy which involves a high level of turnover. The most tax-inefficient investments are those that produce a lot of current income or that incur short term capital gains – both taxed at the less favorable ordinary income tax rate.

Where should I place my different investments?

Placing the most tax-inefficient investments in an account that is tax-deferred such as an IRA or your company 401k will give you the most bang for your buck. A Roth IRA is funded with after-tax dollars, grows tax free, is not subject to required distributions at age 70 ½ and distributions from the account are tax-free. Because of these advantages, holding tax-inefficient investments that also have a relatively high expected return in your Roth IRA is a good strategy. The more tax-efficient investments can be placed in a taxable account.

In practice, asset location is usually not an exact science. Tax-deferred and tax-free (Roth) accounts will have contribution limits, tax rates and your tax bracket will change over time, and your investment mix will also change. Additionally, tax-deferred and tax-free accounts will generally have early withdrawal penalties so this strategy would typically not be used with funds that you need prior to age 59 ½. It is also difficult to move funds between the different types of investment accounts.

Learn where to place investments based on what type of investor you are >

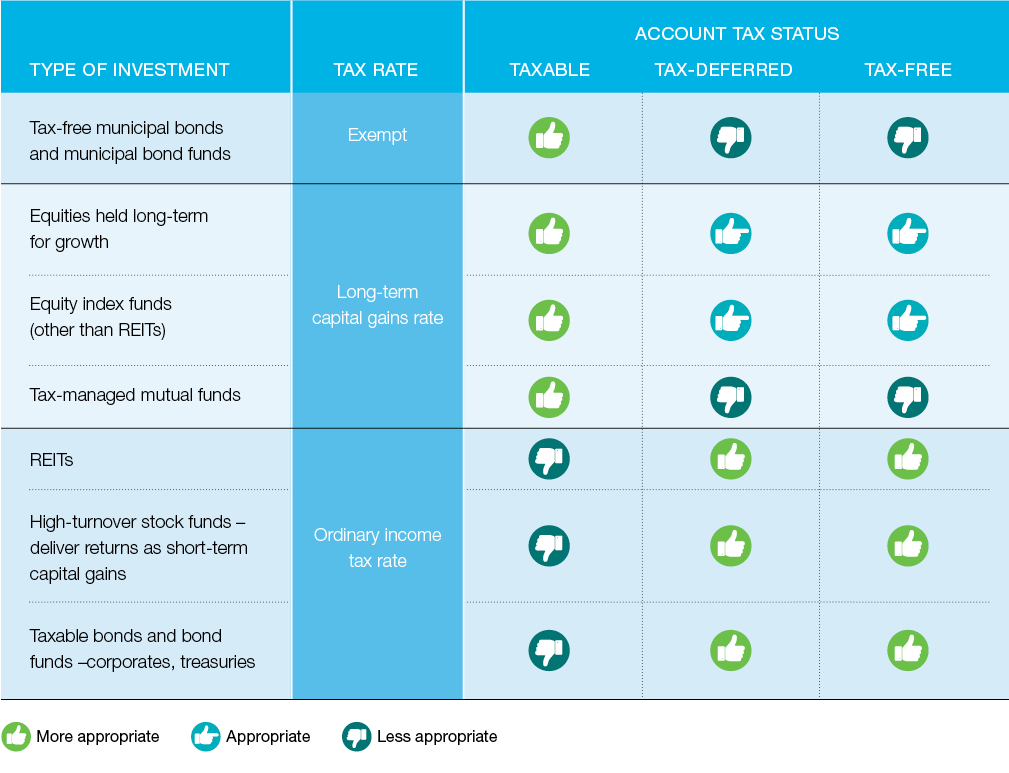

While there are few really hard and fast rules, the following chart may be used as a guide in applying an asset location strategy to your portfolio.

Guide to asset location: Where should I place my investments?

A note on international investments

While generally it makes sense to treat international investments the same in terms of asset location, there may be a slight advantage to holding them in a taxable account due to the foreign tax credit. The foreign tax credit can’t be used in an IRA or Roth IRA, so by having your investment there you’re essentially “losing” the credit. However, this credit is typically small and may be outweighed by other factors.

A simple example

Joanne is a high earning professional with a total portfolio of $1,000,000 consisting of a $300,000 SEP IRA and a $700,000 taxable brokerage account. Let’s assume that the asset allocation per her financial plan is 50% Stocks, 40% Bonds, and 10% Alternatives (REITs). Based on the asset location principles, and assuming the stocks are mostly individual stocks and tax-efficient ETFs, Joanne would allocate all $100k of the REITs and $200k of the bonds to her SEP IRA. She would allocate all the stocks and the balance of the bonds to her taxable account. Depending on her tax bracket the taxable account may hold municipal bonds instead of corporate bonds.

An adviser can help

As stated previously, asset location is not an exact science. Furthermore, every investor’s situation is different so there is no one-size-fits-all approach in determining where to place your investments. Your individual situation will vary depending on many factors including liquidity needs, tax planning and estate planning. We recommend implementing this strategy in the context of an overall financial plan with the advice of a trusted adviser.

Benjamin Franklin once wrote “In this world nothing can be said to be certain, except death and taxes.” You cannot control tax legislation or the markets. However, careful consideration of an asset location strategy will help you reduce the potential tax impact on your long-term wealth. We’re here to help even when it comes to location, location, location.