by

User Not Found

| Oct 30, 2019

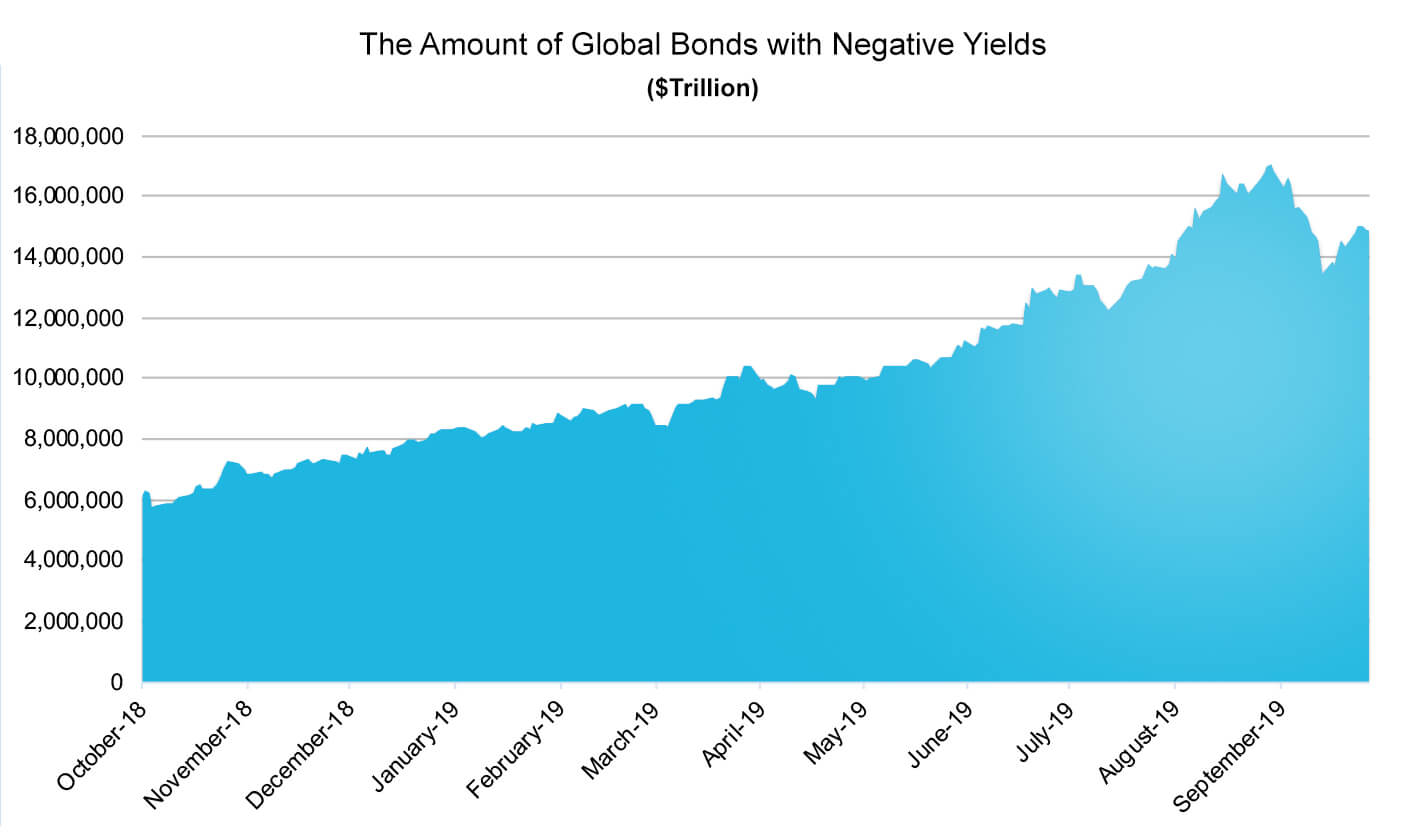

The world is awash with bonds that generate a negative yield. As displayed in the chart below, today roughly $15 trillion of mostly foreign sovereign debt carries negative interest rates where investors pay for the privilege of lending. Simply put, a bond purchased with a negative yield is guaranteed to lose money if held to maturity.

Source: Bloomberg

Low interest rates are the result of weaker global economic growth and persistently low inflation. To combat slowing growth, central bankers including both Bank of Japan and the European Central Bank have lowered interest rates to stimulate their economies. Despite their efforts, slow growth is persistent in both Asia and Europe. For example, Japan recently announced that its economy is growing at a rate of just over 1 percent and China, the world’s second largest economy, posted its slowest economic growth in nearly 30 years in the second quarter. Germany, which exemplifies the Eurozone and is the largest economy in the region, posted a GDP contraction of 0.1 percent during the second quarter and likely tipped into a recession over the course of the summer.

The United States has so far avoided negative yields, yet U.S. Treasuries have not escaped the pinch and rates have decreased substantially this year. The 10-year U.S. Treasury hit all-time lows of 1.45 percent in early September and has only posted a modest recovery to close at 1.60 percent since then.

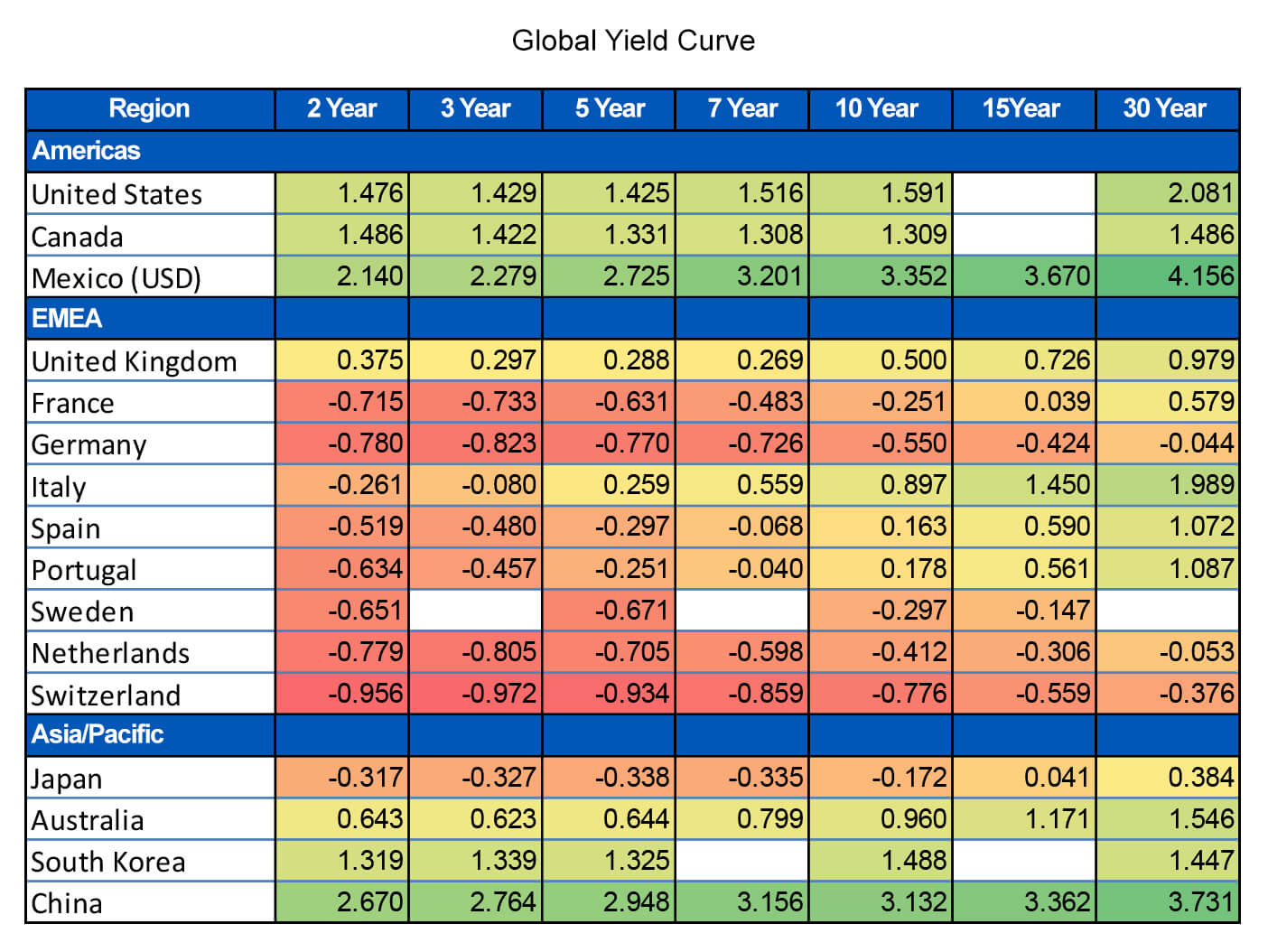

The chart below displays regions with negative yields in shades of red, and regions with positive yields in shades of green. The more extreme the value, the stronger the shade. While negative rates in the U.S. may seem unimaginable, the search for yield emanating from Asia and Europe will continue to apply pressure on U.S. interest rates. U.S. Treasury rates have room to fall further, yet Federal Reserve Chairman Jerome Powell has indicated the United States will not use negative rates as a policy tool against weakening economic conditions.

Source: Bloomberg

As a result of the 2007-2009 Global Financial Crisis, a series of worldwide monetary experiments by various central banks have led to the proliferation of negative interest rates. After other forms of monetary stimulus were exhausted, the Eurozone introduced negative rates in June 2014 to boost a languishing economy with the aim of encouraging banks to lend. Yet negative interest rates have crimped the profitability of poorly capitalized European banks who were already burdened with new financial regulatory reserve holding requirements. Cuts in interest rates have resulted in a flat and sometimes inverted yield curve, threatening the business model of traditional banks which borrow at short term interest rates and lend those funds at longer term rates. Plainly stated, negative interest rates have deleterious effects on the banking system.

Central bankers in Europe and Japan are now confronted with a reality where cutting short term interest rates, one of their primary tools, appears to be ineffective. In the past, central banks could rely on cutting interest rates to encourage risk taking and spur economic growth. However, additional rate cuts do not appear to have the same impact when yields are already at historically low levels.

The economic backdrop of slowing global economic growth and projections of a continuation of that trend reinforces expectations of low interest rates. With a likely environment of persistently low interest rates reinforced by sluggish global economic growth, we continue to believe it is wise to hold an allocation of high-quality bonds. Rates in the U.S. are high relative to those offered in Europe and Japan and provide appreciation potential if interest rates fall from current levels. There are also portfolio diversification benefits since a portfolio of high-quality investment grade bonds should act as a ballast for stocks as well.