by

User Not Found

| Jun 28, 2018

You’ve seen the headlines declaring the “supremacy of growth investing” or the “resurrection of value stocks.” But what do these terms—growth and value—actually mean, and why do they matter? Here’s a look at the importance of growth and value investing, and why we believe that each style has a crucial role in your overall investment portfolio.

Growth: In search of the next big thing

Companies labeled “growth” are investing in just that—growing their businesses, sales and cash flow. Typically, these companies are in the earlier stages of their life cycle and provide a new or completely unique product or service, which is why, often, there is strong consumer demand and faster growth for the company. Because investors are willing to pay more for those promising opportunities, growth stocks often look more expensive on common valuation metrics. Some of the more aggressive growth companies have lofty goals, such as upending the way consumers access and value entertainment content or changing buying habits. In short, they’re doing big things. But because of the “go big or go home” mentality of some growth companies, their stock price is often more volatile, which means a long-term view is crucial for growth stocks.

At Badgley Phelps, we focus on identifying growth companies that have compelling opportunities over the next 3-5 years. This long-term mentality results in our growth portfolio benefiting from secular trends, such as the migration of purchases from physical stores to online, the increased technological capabilities of smartphones and other devices or the shift toward electronic payments vs. cash. We believe companies that are able to successfully navigate these major market shifts will experience higher growth rates and ultimately be rewarded with rising stock prices.

Value: Lower valuations, slower growth and dividends

Unlike their growth counterparts, stocks labeled “value” are generally companies with lower growth prospects but stable business models, often distributing their cash flows to investors in the form of dividends. Value companies may also operate in mature, slower-growing industries or be underappreciated by the marketplace. Value stocks generally trade at a discount to “intrinsic value.” In other words, they offer a chance to buy on sale. Many value stocks are companies with proven business models that are out of favor with investors, either due to poor execution by management or the timing of the economic cycle and the firm’s business prospects. For example, a company that has failed to meet stated goals may leave investors apprehensive, disappointed with management and hoping for a turnaround. Or, another type of value stock, the “deep cyclical,” is a company that makes a large profit during certain times but loses money in other parts of the economic cycle.

We take a slightly different approach to value investing. Rather than buying stocks of companies that have not executed their business plans well or are deeply cyclical, at Badgley Phelps we believe in buying good companies which have valuations that are inexpensive relative to their history or peers. In other words, we’re patient investors who buy good companies when they go on sale. With a long-term investment horizon, we can be disciplined with our purchases and buy companies that have attractive growth prospects at reasonable prices.

Why a balanced approach matters

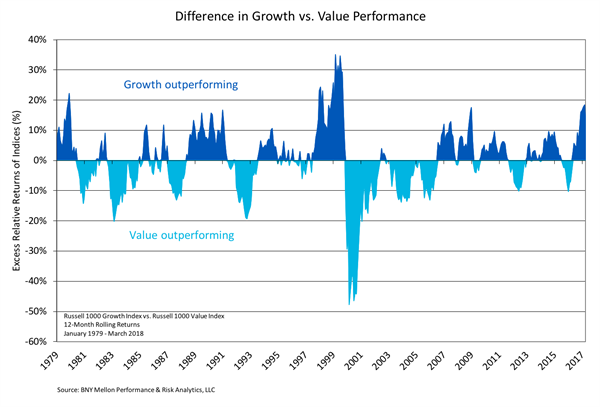

As in life, finding a balance matters in investing. We believe that holding both growth and value stocks is a prudent way to manage risk. Instead of chasing the most recent market fad or trying to predict the next big trend, we construct a portfolio that can provide consistent results by buying high-quality companies for the long term. That way, no matter where we are in the economic cycle, you can feel comfortable knowing that your portfolio holds quality investments which should perform well over time. As the chart below depicts, the market rewards different kinds of companies at different times. Badgley Phelps’ portfolios allow our clients to benefit from secular growth trends as well as high-quality companies whose stock price is on sale. We believe this is a strategy that generates both growth and value over the long term.